Margin Calculator Explained: Avoid Margin Calls with Smart Planning

Introduction

Margin calls are the worst fear of all traders. Your trades are going through and then your broker is closing them for you because you have run out of funds needed. It is when the traders do not prepare for their margin.

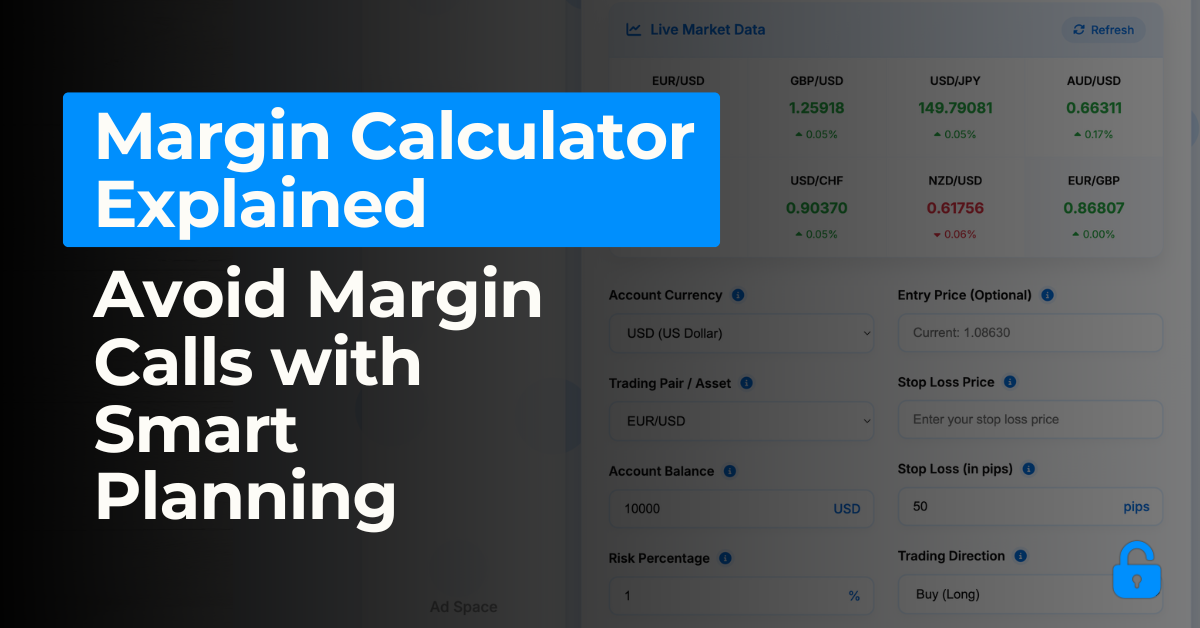

Margin calculator is a simple, convenient tool that helps you pre-plan trades, avoid unexpected margin calls, and minimize risk. Here in this guide, we will explain how margin works, how to employ a margin calculator, and how trading can be done safely.

What is a Margin Calculator?

A margin calculator is an online or in-platform tool that shows how much margin is required to open and maintain a trade.

It helps you:

- Determine the required margin for a position.

- Plan trade sizes based on your capital and leverage.

- Avoid over-leveraging and potential margin calls.

In short, it’s your first line of defense against poor risk management.

How Margin Works in Trading

Margin: The portion of your account balance set aside by your broker to keep a trade open.

Leverage: The ability to control a larger position with a smaller amount of capital. It’s expressed as a ratio (e.g., 1:50, 1:100).

Example:

- If you have $1,000 and use 1:100 leverage, you can control up to $100,000 in trades.

- But higher leverage increases risk—losses are magnified.

Risks of Margin Trading: What is a Margin Call?

A margin call happens when your account’s equity drops below the broker’s required maintenance margin. This usually means:

- Your losses are too high relative to your balance.

- The broker may close your positions to prevent further loss.

Why margin calls happen:

- Over-leveraging.

- Not using a stop loss.

- Trading without checking margin requirements.

Step-by-Step: How to Use a Margin Calculator

Example Values:

- Trading capital: $10,000

- Margin requirement: 20%

- Position size: $50,000

Calculation:

Required Margin = Position Size × Margin Requirement

= $50,000 × 20%

= $10,000

This means:

- You need $10,000 in your account to open and maintain this trade.

- If your balance drops below the maintenance margin, you risk a margin call.

How to use the calculator:

- Enter your account currency.

- Input the trade size (position size).

- Select the margin requirement or leverage.

- The calculator will instantly display the required margin.

Benefits: Preventing Margin Calls and Planning Smartly

- Avoid over-leveraging by knowing exact requirements before placing trades.

- Trade with confidence by aligning position sizes with your account size.

- Improve discipline by sticking to pre-calculated risk levels.

Reliable Margin Calculator

- PipsLock Margin Calculator – Reliable and easy to use.

Best Practices to Avoid Margin Calls

- Never risk more than 1-2% of your account per trade.

- Always check the margin requirement before opening a trade.

- Keep extra free margin for market volatility.

- Use a stop loss to control downside.

- Avoid holding oversized positions overnight.

Conclusion

Margin trading amplifies gains and losses both. If one is not cautious, they may end up triggering a margin call and losing money.

A margin calculator keeps you from making this by clearly showing you how much capital you need to have for each trade. Use it on every position—you'll trade better and sleep better.

Before you place your next trade, run the numbers. Use a margin calculator to plan smartly, avoid margin calls, and protect your capital.